3 Areas of Focus for Building a Sustainable Deposit Strategy

Now is the time to fortify your defenses for the war on deposits.

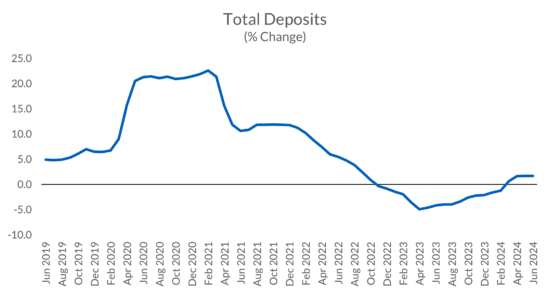

Halfway through 2024, most banks and credit unions have settled into the current environment— for better or worse. Yes, the initial panic has worn off, but dwindling deposits and sustained interest rates have considerably impacted funding costs and growth outlooks.

But a faint light is starting to show at the end of the tunnel. After sliding for roughly two years, deposit growth is finally beginning to climb.

Source: FRED

With deposits trickling back into the banking system and the promise of a potential rate cut this year, banking executives are experiencing a glimmer of hope.

But smart leaders know now is not the time to let off the gas pedal. Instead, it’s time to build deliberate strategies to ensure a sustainable approach to deposit growth.

Here are three areas where troublemakers are fortifying their defenses and preparing for the ongoing war on deposits.

1. Protect and grow existing deposits through analytics

The challenges of the current banking environment are a stark reminder that deposits are an institution’s lifeblood.

Static, canned deposit balance reporting won’t cut it in today’s battlegrounds. That’s why many leading institutions are turning to deposit analytics tools that can add sophistication to their deposit management strategies.

By leveraging internal data, these tools help institutions:

- Segment and target customers. Deposit analytics allows banks to segment their customer base and identify high-value depositors. This enables more targeted retention efforts for the customers most likely to maintain or increase their deposits.

- Predict attrition risk. By analyzing customer behavior patterns, deposit analytics can help predict which customers are at risk of withdrawing funds or closing accounts. This enables banks to proactively engage those customers with retention offers.

- Optimize pricing strategies. Analytics provides insights into how deposit pricing decisions impact customer behavior and balance levels. This helps banks set competitive rates to retain deposits without unnecessarily increasing costs.

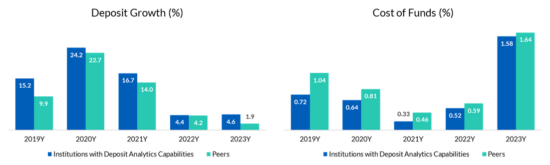

An internal analysis of Cornerstone clients with known deposit analytics capabilities consistently outperformed their peers for both deposit growth and cost of funds over the past five years.

Source: Cornerstone Advisors, S&P Global

Leveraging deposit analytics enables banks and credit unions to gain a more comprehensive and data-driven understanding of their deposit base. This assists them in making more informed decisions about pricing, product offerings, marketing and customer engagement strategies—all of which are critical for maintaining existing deposits in an increasingly competitive banking landscape.

2. Maximize new deposit relationships with an effective onboarding program

Institutions spend considerable resources to capture new customers, but once the account is opened many institutions do little to capitalize on the new relationship.

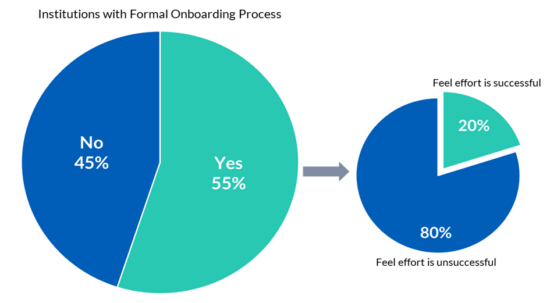

According to Digital Banking Report, 45% of banks and credit unions do not have a formal onboarding process. Of the institutions that do, just 20% feel the effort is measurably successful. This means only about 10% of banks and credit unions successfully engage their customers post-account opening.

Source: Digital Banking Report

This is why institutions should reevaluate their onboarding processes to turn lifeless accounts into engaged customers. Implementing a formal onboarding process contributes to deposit growth in a few ways:

- Improved customer engagement. Effective onboarding helps customers quickly adopt key services like direct deposit and bill pay, which are associated with higher balances.

- Reduced account closures. Less than half of new checking accounts are typically active after 90 days. Effective onboarding can reduce early account closures, preserving potential deposit growth.

- Increased cross-selling opportunities. Onboarding creates chances to introduce additional relevant products and services, leading to more deposit accounts and higher overall balances per customer.

Designing and managing an effective onboarding process is no easy undertaking, which is why many institutions are turning to digital onboarding providers such as Digital Onboarding to streamline the process. Whether an institution handles its onboarding program internally or partners with a provider, the onboarding process is essential to maximizing new deposit relationships.

3. Secure the future deposit base through youth banking

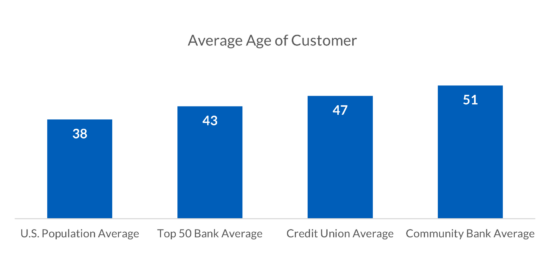

Over the past decade, community banks and credit unions have witnessed a concerning trend: their customer bases are aging faster than the national average.

Source: Cornerstone Advisors

One driver of this trend is the fact that many community financial institutions were slower than their larger competitors to adopt technology demanded by younger generations (evidenced by the pandemic-driven boon for digital banking and digital account opening solutions). In addition, fintech and “challenger banks” continue to capture a significant share of the younger demographic.

Most traditional financial institutions have struggled to capture younger customers because they have not offered solutions that meet the current needs of today’s digitally native youth. To capitalize on this significant opportunity, banks and credit unions need to ditch their conventional methods of serving young customers in favor of a more modern approach: youth banking apps.

Youth banking apps (also known as family digital wallets and family finance apps) are apps designed to provide younger consumers who would otherwise not be able to open a banking account with the tools to begin their first foray into finances while providing parents with the ability to monitor and control their activity.

In general, these youth banking apps offer some form of a savings account, a debit card, and an element of education to promote financial literacy. They also typically include features that let parents control their children’s spending and transfer money to them from parental accounts.

Recent announcements highlighting the growing momentum in this space include CSI partnering with REGO to offer a family digital wallet, Affinity Plus FCU partnering with Boucoup to launch a youth banking app, and PSECU partnering with Greenlight to provide a family finance app.

As customer bases age and acquisition costs continue to increase, offering a youth banking app should be viewed as an investment in the future for a financial institution’s deposit base, with the larger payoff coming from retaining these customers into adulthood.

(For more research on family banking apps, download our report The Rise of Family Digital Wallets)

After the current rate battle, the war on deposits will persist. Retreating will not be an option. Banks and credit unions must develop deliberate strategies to protect existing deposits, maximize new deposit relationships, and secure their future deposit base.

So, stay focused Gonzobankers. The sustainability of your balance sheet depends on it.

Tristan Green is a director at Cornerstone Advisors. Follow Tristan on LinkedIn.