Strategy

Web & Mobile Banking

Marketing

HR & Training

Retail Banking

call center

Best Practices

information technology

bank delivery channels

bank delivery investments

return on channel investments

bank delivery strategy

The 3 Dimensions of Bank Delivery Channel Management

Understanding their Return on Channel arms bank executives with the insight to better manage delivery investments and strategies.

The shift in customer delivery channel usage is simply the most significant strategic challenge bank executives will face over the next decade. Unfortunately, most organizations are using outdated and flawed frameworks for managing this shift. To drive greater financial value, bankers must shake up their branch-centric perspective and embrace a more integrated view of delivery channel performance management.

Most bankers grew up in the era of the branch profit and loss statement (P&L), which made sense long ago when the bulk of customer revenue generation, usage, and retention of revenue was hitched to brick and mortar. Today, the digital, contact center and outbound channels have become equally important sources of revenue generation. In addition, as banks begin to pour increased money into digital delivery and branch transformation, the more important it becomes for executives to fully understand the prioritization and return on those investments and to better hold managers accountable to achieve value-creation goals.

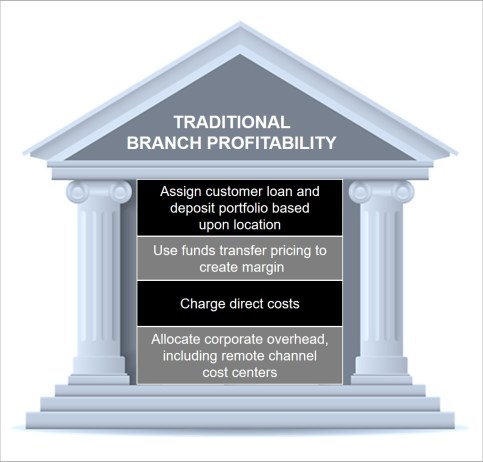

The traditional branch P&L model that drove delivery channel investments basically looked as follows.

This model is flawed in a multi-channel world where sales are generated in one location and transactions conducted elsewhere. In addition, it is a backward-looking model as customer behavior around retention of loans and deposits has changed with increased remote access offerings. An executive team that focuses their channel decision making will likely over-invest in brick and mortar to their own demise.

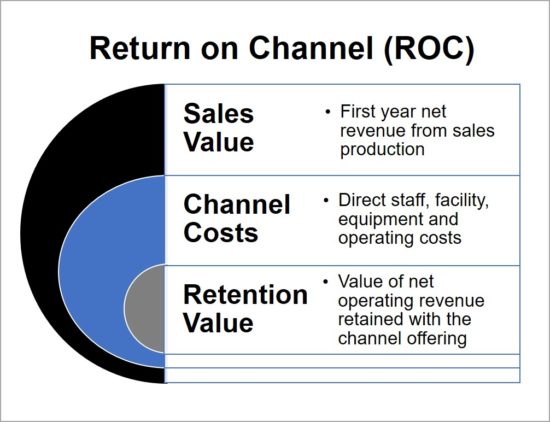

Instead of old tools, bank executive need to adopt a framework that recognizes the multiple dimensions on how delivery channel investments create value. At Cornerstone, our team has developed a rigorous Return on Channel or “ROC” model to reveal the most important delivery channel insights.

The ROC framework bluntly focuses executives on the fact that ANY delivery channel investment can be evaluated along three dimensions:

Here’s a rundown of how executives can analyze the 3 Dimensions of Delivery Channel Management:

1. Sales Value – At their core, delivery channels must drive new sales and revenue, and banks must begin fortifying their remote customer experience to sell more in a digital world.

In the old days, when everything was branch driven, banks spent their time arguing about which customers belonged in which branch and reassigned households from one branch to another based upon recent usage patterns. Today this is a royal waste of time, and executives need to account for the fact that new account and loan production is happening across all channels, or at least it should be.

Reviewing channels and branches for their sales value exposes managers to the harsh realities that some channels or branches just don’t generate many sales relative to others. The ROC framework evaluates the sales value of each location and channel based upon the incremental annual net operating revenue generated on current sales. While tracking sales and production volumes may be straightforward, it’s important in the ROC framework to apply accurate spreads, fee income, and average balances to clearly see the value creation through the “front door.”

2. Channel Costs – The ROC model focuses only on direct channel costs in its evaluation. Cornerstone recommends this narrower focus for three reasons:

- It greatly expedites and simplifies the cost analysis and ongoing updates.

- Company overhead, information technology, marketing and human resources expenses don’t change significantly based on most ongoing channel decisions.

- Direct costs are much easier to compare to peers for benchmarking purposes.

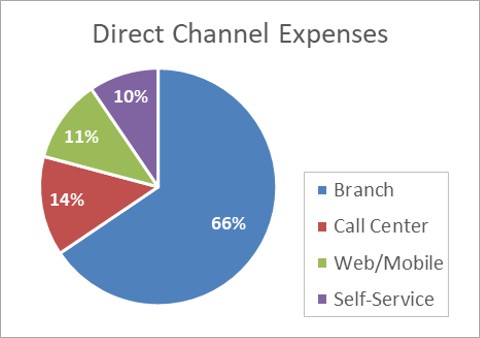

In Cornerstone’s experience, direct branch expenses will account for 60%-70% of all channel expenses. The remaining third breaks out evenly across call center, digital, and ATM/self-service channels.

3. Retention Value – Cornerstone’s ROC framework recognizes that a great deal of delivery channel offerings and investments exist not to generate sales but rather to provide a convenient and user-friendly experience to customers.

Retention value must reflect a combination of where the activity occurs (branch, digital, ATM/ITM, contact center) and what revenue is retained by offering this channel convenience. Examining usage across channels, the revenue value of customers using those channels, and the importance of channel functionality to retaining that revenue allows for better decision-making on both existing channels/branches and investments in new areas.

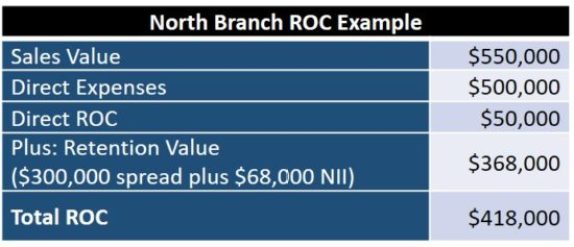

Let’s take a branch as a simple example. The North Branch is generating $550,000 in incremental annual revenue and $500,000 in direct expenses. However, it is estimated that if the branch were closed, 20% of its $100 million in deposits would run off, taking with it $300,000 in spread income and $68,000 in interchange/fee income. This translates into $368,000 of retention value for the branch and makes the total ROC after retention value $418,000.

This framework can also be very powerful in evaluating new digital channel investments. Mobile remote deposit capture may seem expensive, but bank executives should think for a minute about what type of runoff might occur among depositors if that competitive capability did not exist. Snapping a picture of a bill to automatically create a bill pay payee may seem really cool, but will it attract new customers or increase the retention of existing customers? These are the important investment and channel development debates that executives should focus on.

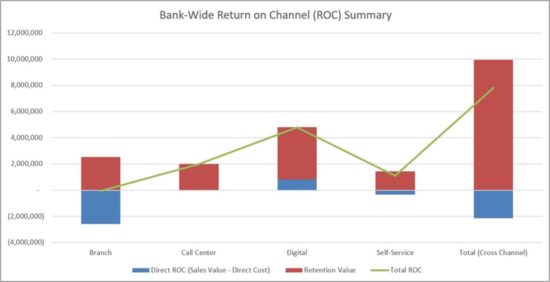

An institution’s ROC may look like the sample below.

By understanding its Return on Channels today, an institution will have the knowledge to manage delivery investments going forward. It will be positioned to understand when branches should be closed, how to value upgraded mobile capabilities, when added seats in the contact center are warranted, etc. It can model the impacts of forced or anticipated behavior shifts in sales and transactions, understand the hard-nosed financial risks and rewards, and hold the organization accountable for results.

So, GonzoBankers, dump the outdated accounting of a world long gone. A ROC lens provides the insights needed to effectively manage channel investments and navigate the transformational journey in customer usage and expectations.

-jb