Managing Bank Regulations: Are You a Dodo or a Cockroach?

Remember the toy, Spirograph? You probably had one when you were a kid.

Remember the toy, Spirograph? You probably had one when you were a kid.

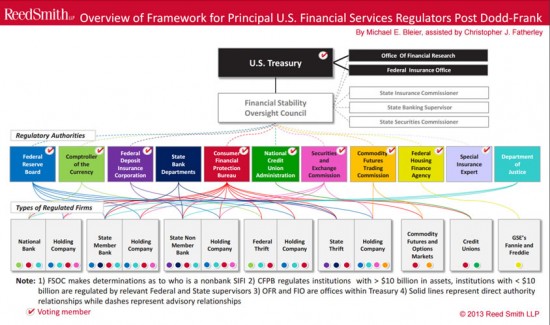

If you used the Spirograph toy on the following chart—which depicts the U.S. financial regulatory environment—you wouldn’t be making the chart any more complex and confusing than it already is.

The amount of regulation in the financial industry is staggering and has understandably been top of mind for most CEOs. According to Cornerstone Advisors research, roughly six in 10 community bank and credit union CEOs are concerned with the regulatory burden. That’s down slightly from the 2015 level, but still one of CEOs’ top three concerns overall. Obviously there are significant burdens and future changes to be concerned about, but so what?

My colleagues (shout out to Vincent Hui and Kaleb Seymour) and I conducted a study for the credit union industry to determine the impact of regulation. Some loyal GonzoBankers were participants and I’ll reiterate my thanks for the painstaking work it took to collect the data. We are hopeful that community banks will also pursue efforts to communicate the real cost of regulatory burden to our friends in Washington.

After absorbing the results we accrued over several months of research, the lesson that stood out the most was that a great portion of the financial burden is self-inflicted. Being an advocate of policy change is great, but banks should simultaneously find ways to minimize the obstacles internally. Voicing the need for better regulatory balance without adapting to the current environment is going the way of the dodo bird.

The number of financial institutions has decreased nearly 30% in the last 10 years, and consolidation continues. While we’re a far cry from community bank extinction, there’s a surprising number of “Dodo Banks” that belong on the endangered species list. Our regulatory study found that a typical financial institution with $1 billion in assets may be spending more than peers on regulatory related costs to the tune of $1 million to $2 million per year.

What banks are setting the benchmark of success? Cockroaches. They aren’t necessarily sexy or cool, but cockroaches are extremely efficient and manage to thrive even in harsh environments. The best banks aren’t just compliant with new regulations. They evolve their operations to find the optimal workflow and supporting processes to overcome every new obstacle.

To help your bank avoid extinction, I devised a very scientific (yet to be independently validated) Dodo Bank Test. For each of the 10 regulatory impacts below, compare your implementation with the two approaches and rate your implementation on a scale of 1 – 5 (1 = Dodo Approach, 5 = Cockroach Approach).

| Regulation | Cockroach Approach (5) | Dodo Approach (1) | Score |

|---|---|---|---|

| Overdraft Requirements | Consent is seamlessly incorporated into paper and online applications with enrollments automatically applied to core via system integration. | We discontinued ODP because it wasnt worth the hassle. | |

| CIP/BSA/AML/SAR /CTR | Systemic tracking of activities across channels and branches, auto-filled forms, integrated risk ranking and easily accessible reporting. | BBQ/JK/LOL/IDK/???...we just deal with acronyms as they come. | |

| Training Requirements | Calendar of training across the organization supported by virtual delivery and electronically captured confirmation. | Its December 31! Everyone go search BSA on Google! | |

| Mortgage Originations | An integrated point of sale for online applications and origination systems supporting a digital loan file with built-in compliance checks, interfaces to vendors (e.g., appraisal management) and reporting. | We buy lighter paper so our loan files arent so heavy with the additional disclosures. | |

| TCPA (Cell Phone Dialer Consent) | Consent verbiage incorporated into applications and online banking when accepting phone numbers as well as a central source to store explicit permission to use automated dialing. | Were friendly bankers who offer a great customer experience so Im sure our clients consent. | |

| Call Center Recording | Any call can be recorded, stored and reviewed without manual steps from call center agents. Bonus points for querying and analytical capabilities. | Jeanine the manager listens in on phone calls occasionally to make sure staff is being nice to people. | |

| Reporting | Financial system integrated with core bank data to produce required reporting (e.g., Call Report) accurately and with minimal analyst manipulation. | Querying data from different sources and throwing them into hundreds of spreadsheets provides us the flexibility to choose the results we like more. | |

| Vendor Management | Pushing past required vendor risk management to vendor performance management. Due diligence calendars and risk ratings are minimal effort while business lines are frequently working with vendors to optimize system utilization, SLAs, campaign management, etc. | Our sales rep reaffirms his commitment to our core values every time we auto-renew a contract and get that free round of golf. | |

| Complaint Management | Treating customer feedback through any channel similar to formal complaints to the CFPB. Manage a system with the ability for employees to submit complaints that are reviewed by management and analyzed to identify trends and opportunities across the organization. | Outlook reminds us to check for regulatory complaints and all other feedback is collected through randomly sent, seldom completed NPS surveys. | |

| Interchange | Make up for lost revenue with a robust payments plan to drive card penetration and activity, push signature rather than PIN transactions, and approach contract negotiations armed with competitive pricing information. | Interchange is going away slice by slice and we just cant bank on that income anymore. | |

| TOTAL |

Now that you’ve no doubt accurately and fairly rated yourself, add the total score and see where it fell on the evolutionary scale.

45 – 50 points: COCKROACH

Able to evolve at an astounding rate, could survive a regulatory nuclear explosion and will never become extinct

40 – 45 points: COYOTE

Adaptive and agile while opportunistically seeking more advantages

35 – 40 points: CAMEL

Comfortable being a survivor, but will never be confused with a thoroughbred

30 – 35 points: PANDA

Endangered species stubbornly sticking to old habits and likely being propped up by local popularity

Less than 30 points: DODO BANK

Eerily reminiscent of a species not seen since 1662 and risking extinction without a major overhaul

Evolving with regulation to avoid extinction is banking Darwinism that boils down to operational excellence. Process design and discipline on the regulatory side creates impact in the millions of dollars. Don’t be a victim of regulation—be a disciplined manager of unavoidable business process requirements. Be a cockroach!

-rm

Regulatory burden getting you down?

Through a host of consulting services, Cornerstone Advisors can help financial institutions lighten the heavy load of regulation—while saving potentially millions of dollars in the process.

- Performance Solutions

Including performance evaluation, performance metrics, performance improvement, and workflow management - Vendor Management Solutions

Including due diligence, vendor selection, vendor management software, and outsourcing programs - Contract Negotiations and Payments Growth

Including assessment and execution of contracts (telecom, core, Internet banking, bill pay, debit and credit card processing, EFT and ancillary systems), and Payments programs

Contact us today to learn more.