“There’s been times that I thought I couldn’t last for long. But now, I think I’m able to carry on.”

–Sam Cooke

Gonzo Nation, 2024 went by so fast that nobody had a chance to stop and think about what in the world was going on. Let us pause and reflect.

In retrospect, this was a funny year. If you look at the performance fundamentals, the industry held its own. In a 12-month reality of higher rates, ROA held steady. Loans and deposits grew, even if only by single digits. Cost of funds increased, but loan yield did as well, so margin held nicely.

Permanently challenged fee income decreased only a little. The yield curve flattened a bit, bank stocks were up 15%, and mergers picked up steam in Q4. Overall, this was a remarkable performance in the toughest of economic environments.

At the same time, bankers faced a fast-accelerating field complexity on many fronts. Fraud issues were highlighted by sophisticated breach and ransomware attacks. Early AI initiatives have everybody trying to decide when and where to invest. Fintech competitors grew, matured and enjoyed another year of crazy valuations. Regulation was as burdensome as ever, but most bankers are lighting candles for some relief on this front with the new administration.

That’s a load to deal with in 12 months, but our Troublemaker industry balanced both the fundamental and complex challenges while continuing to make customers’ financial lives better. And that, friends, is what we at Cornerstone admire and salute the most.

That said, you are tired and in need of an insightful and witty year-end diversion. We humbly offer the 2024 GonzoBanker awards for your review. Open up your favorite canned or bottled beverage (nothing that requires harvesting, please) and enjoy.

It is an honor to serve this industry.

THE BANKER AWARDS

The Smarter Bank Awards

Every year, Cornerstone recognizes the “smarter banks” that are modernizing their business and growing in focused and strategic ways. Let salute this year’s standouts:

- Smarter Bank Hyper-Efficient Award – Goes to the team at Space Coast Credit Union, Melbourne, Fla. CEO Tim Antonition has literally gone from teller to top chair in his 34-year career with the credit union, and he’s been a student of efficient operations. With centralized Express sales, a dedicated Operational Excellence group, and extensive process automation work done in partnership with tech firm ClaySys, Space Coast has shown how leaning into new approaches to efficiency can yield a 2.5% non-interest expense/asset ratio in a full-service community credit union.

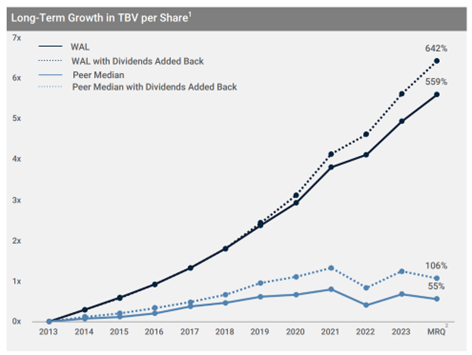

- Smarter Bank Differentiated Award – goes to Ken Vecchione and the team at Western Alliance Bancorporation. This diverse franchise, founded by famous banker Robert Sarver 21 years ago, has grown to $80 billion in assets with a $10+ billion market cap. This bank pursues unique niches that other banks might find risky, but Western Alliance goes deep with specific industry and credit expertise to turn out a whopping 3.61% net interest margin with only a .45% non-performing loan ratio. We’re glad to see Western Alliance at full tilt after short-sellers and naysayers gave the bank reputational trouble in 2023. We’re sure the team would say their total returns compared to peers outlined in the chart below are the real proof of long-term bank quality.

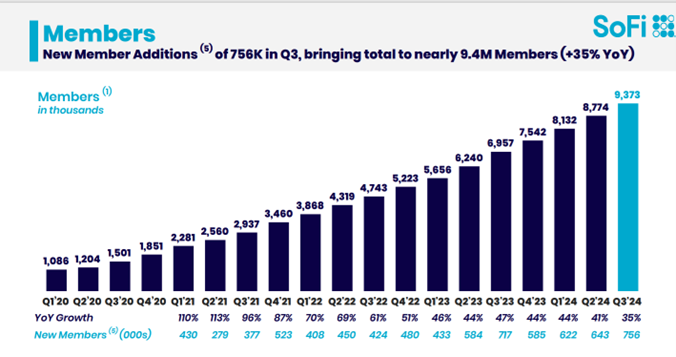

- Smarter Bank Nimble Award – goes to Anthony Noto and the team at SoFi. SoFi stock boomed back close to 100% this year and now stands at a crazy 88 price-earnings ratio. Why? The market sees the growing diversification away from loan income and JP Morgan analyst Reginal Smith said SoFi may become the “American Express” of fintech. With breakout growth in its third-party loan platform (which generates fee income) and the growth of its Galileo technology platform, SoFi has many engines for future value creation, all while growing members from 1 million when COVID started to move than 9 million today.

- Smarter Bank Data-Driven Award – goes to Aaron Graft and the team at Triumph Financial for the continued gritty development of its TriumphPay platform for the transportation industry. TriumphPay is focused on being the frictionless center of presentment, settlement and payment experiences for brokers, carriers and shippers, and factors to optimize cash flow and efficiency in this whole system. This is a great example of a bank truly adding the ability to improve a client’s performance while tapping into the long-term value of the platform. And, oh by the way, Triumph’s stock (TFIN) trades close to three times book value.

- Smarter Bank Opportunistic Award – goes to Fifth Third Bancorp for the dual pursuit of its Southeast market expansion and fintech strategy. In the age of digital and fintech, good ol’ 53 plans to open 50 branches a year in Southeast growth markets for the next four years. By the end of the expansion, the bank’s footprint is expected to be evenly distributed, with approximately 50% of branches in the Midwest and 50% in the Southeast. While it may sound a bit cliche, Fifth Third has put impressive growth and efficiency numbers on the board with its Southeast expansion that began in 2017 – average time for a new branch to break even is 36 months. At the same time, CEO Tim Spence is pursuing innovative fintech strategies, with a BaaS play via Newline, its embedded payments provider and API platform, and the continued focus on the Provide division, a healthcare fintech acquired in 2021.

Bank Acquisition of the Year – has to go to SouthState Corporation for its big move into Texas with the acquisition of Independent Bank Group. For a cool $2 billion, CEO John Corbett and team got $16 billion in deposits and strategic entries into the growth markets of Dallas, Houston, Austin and Denver.

Bank Merger of the Year – Although this technically was an acquisition, the $25 billion Atlantic Union Bankshares combining with $14.4 billion Sandy Springs Bancorp builds a powerhouse in the Mid-Atlantic region. Hats off to Atlantic Union’s John Ashbury and Sandy Springs’ Dan Schrider for getting this deal announced.

Credit Union Merger of the Year – This award was easy since the combination of First Technology Credit Union and Digital Credit Union is now the largest merger in this industry’s history. CEOs Greg Mitchell and Shruti Miyashiro have teed up a $28 billion national digital-first consumer financial institution with a keen focus on pooling resources in digital, I.T. and marketing to compete in a new playing field. Credit unions of all sizes are still processing the impact of this groundbreaking MOE.

Conversion of the Year – WaFd and Luther Burbank accomplished their operational merger integration in five days. CEO Brent Beardall is proud of his team for this historic milestone.

GonzoBanker of the Year (Regional Bank) – goes to Kevin Blair of Synovus Financial Corp. Make no mistake, Synovus has broken from tradition in building a regional commercial bank whose stock is up 55% this year, recovering nicely from the industry’s rough days in 2023. Importantly, Blair has shown a keen appreciation for how culture, customer loyalty, technology and product management are critical in creating value for a future “smarter bank.” With a 17% return on tangible common equity and double-digit growth in noninterest income for the past five years, we believe Blair’s strategy for franchise value is rock solid.

GonzoBanker of the Year (Mid-Size Bank) – goes to Malcolm Holland of Veritex Holdings. Holland, who started his first bank at age 26, had a dream of building a Texas banking category killer when he and team members founded Veritex 15 years ago. Since that time, Veritex has grown to a dynamic, efficient organization with $1.6 billion in market cap. Congrats to Malcolm and his team for the pursuits along their mission of “Bringing Truth, Transparency, and Integrity to Banking.”

GonzoBanker of the Year (Credit Union) – goes to humble and hard-working industry maverick Kim Sponem of Summit Credit Union in Cottage Grove, Wis. In her time as CEO/president, Kim has led Summit from $200 million in assets to more than $7.5 billion, including a purchase of $835 million Commerce State Bank in West Bend, Wis. Most importantly, Kim has focused Summit on a core mission of empowering women, and others, in building financial security, wealth and avoiding poverty in retirement. This mission runs through every aspect of the organization, from financial education to products, community events and charitable giving. Bravo to a true impact player in financial services.

Lifetime Achievement Awards (Banks):

- Walt Bettinger, Charles Schwab capped off an amazing career and brought Schwab incredible shareholder value creation

- Jeff Haley, American National Bank, a great banker who brought additional scale to Atlantic Union Bank in a deal done in 2023.

- Dick Bove, famous bank analyst. Dick always spoke his mind good and bad through decades of banking history

Lifetime Achievement Awards (Credit Unions) – we tip our hat to four credit union CEOs who put their mark on successful organizations from coast to coast:

- Geri LaChance, SESLOC

- John Hirabayashi, Community First Credit Union

- Debra Schwartz, Mission Federal Credit Union

- Boyd Gustke, Connexus Credit Union

No More Marketing Fire Drills Award – goes to Barb Bowker from Pennsylvania State Employees Credit Union. Barb deservedly decided to retire in April after more than 23 years at PSECU. Over the last 20 years as head of marketing and more recently member experience, Barb was an instrumental member of the executive team that grew PSECU from $1.5 billion in 2001 to $8.2 billion today.

Walking the Walk – goes to Valley First Credit Union. Since Kathryn Davis stepped into the CEO role in 2019, Modesto-based Valley First has secured and deployed millions in CDFI and FHLB grants, partnered with municipalities on hyper-local programs, found creative financing solutions for start-up small businesses, and forged public-private alliances with organizations like the VOLT Institute (a vocational school focused on specialized industrial skills). Kudos to Kathryn and team for living their mission of “Making Good Happen” and for driving real, positive change in California’s Central Valley.

Gonzo Creativity – goes to INSBANK for its spoof videos. This Tennessee bank boasts a Gonzo spirit embodied by CEO Jim Rieniets. Growing up, Jim couldn’t decide if he wanted to be a secret agent, a basketball player, a specialty surgeon or a fighter pilot. In high school, he found work as a disc jockey for a country music radio station. In the end, he settled on banking, where he and his team now produce some of the best (and funniest) videos about banking we’ve come across. Their parody of The Hangover, which spoofed the regulatory reaction to the financial crisis, remains one of our team’s favorites.

Meatiest Marketing Idea – Community Financial Credit Union for creating online resources to help survivors of economic abuse.

Best Startup Bank Podcast of the Year – Goes to Lake City Bank’s Community Development groups show. It’s produced in the back office of a Boost Mobile office that CEO David Findlay found out about by accident.

Best Show of Bravado – goes to Jamie Dimon for threatening to sue the CFPB. Now that the CFPB is sweating bullets with the new administration, you might not think that challenging a regulatory agency with little oversight is risky. Still, Jamie and the team at Chase had enough of the unintended consequences of poorly thought-out proposed rulemaking and threatened to sue the CFPB. As my dad used to say, “There is always a bigger bully on the playground, so be nice.”

The click_here_this_is_not_a_phishing_email award – goes to the fraud and digital banking team at Security Financial Bank in Durand, Wis. Security Financial Bank’s home page starts off with fraud education for its customers and it actively maintains and updates its Facebook page with common fraud scenarios. If a bank with $830 million in assets can consistently make fraud education a priority, so can others.

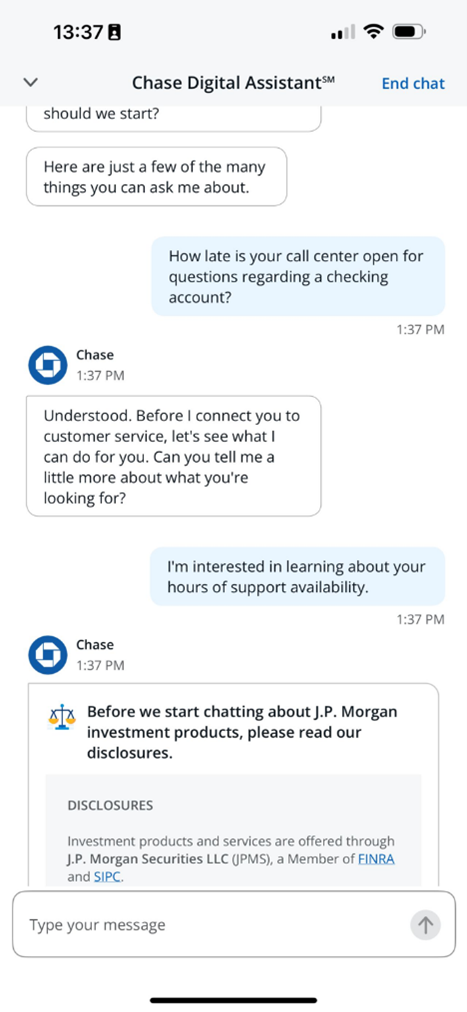

The Great AI Hype Award – goes to Chase Bank for its AI digital assistant not being able to answer a basic support hours question.

THE FINTECH AWARDS

Bank Technology of the Year – Account opening fraud management. There’s no eliminating fraud. But there are ways to reduce it from entering or expanding within the financial services industry, and the methods are much more sophisticated than a questionable staple: using knowledge-based authentication questions. The good news: 2024 saw all kinds of progress in account opening fraud management from bank tech vendors that also helps save financial institutions from manual review work. Look to Alloy, Sardine and Effectiv (recently acquired by Socure) as the leaders in the fight across account opening fraud management. We applaud these industry developments against a formidable force. According to Alloy’s 2024 fraud study, identity theft, synthetic identity theft and account takeover fraud accounted for 31% of all fraud losses by U.S. financial institutions last year.

Fintech Startup Innovation of the Year – Laurel Taylor, founder and CEO of fintech firm Candidly. In January 2024, a policy shift allowed for employers to match contributions to employees’ retirement plans when their employees make student debt payments. It’s part of SECURE Act 2.0. This award goes to Laurel Taylor, the founder and CEO of fintech firm Candidly, for working with employers – banks and bank tech providers included – to make it so. Candidly calls the product the Student Loan Retirement Match Solution, and the innovation helps a wider group of people build their long-term savings while it also helping employers (like banks) improve their talent retention.

Core System Deal of the Year (Bank) – Tata Consultancy Services (TCS) BaNCS’ March-announced win of $20B Central Bank (Missouri). Bank management wanted to consider non-traditional cores and ultimately decided to partner with the India-based TCS, which recently completed a well-publicized implementation at $87B Zions Bank. More and more regional banks are looking outside of The Big 3 core providers, which is a big opportunity for TCS and its global peers.

Core System Deal of the Year (Credit Union) – Corelation’s April-announced win of $4.8B Genisys Credit Union in Michigan. There were several big wins from others in 2024 (and more coming at press time), but the Genisys win stood out, not only in size, but in the influence of Genisys CEO (and former CIO) Jackie Buchanan’s career leaning into tech publicly on multiple boards and councils. Corelation is on an unmistakable growth tear winning this award last year as well.

Digital Deal of the Year (Bank) – Q2’s win of $9.4B Byline Bank in Chicago. The bank made the decision for a digital banking change on both commercial and retail to grow deeper in existing markets as well as position for future growth. The commercial-retail combo meal has been the Q2 hallmark, winning this award last year as well.

Digital Deal of the Year (Credit Union) – Candescent D3’s June win of $19.5B Golden 1 Credit Union in California, the nation’s sixth-largest credit union with over a million members. Golden 1 management pointed to taking control of its own digital banking destiny. A pattern has developed of larger shops looking to do more customizing with D3 now winning its third digital deal of the year award in five years.

Vendor Acquisition of the Year – Three-way TIE:

- Veritas Capital’s September acquisition of Candescent (FKA NCR Voyix Digital) for $3.5B

- Moody’s November acquisition of Numerated

- CSI’s pearls-on-a-string acquisitions of Hawthorn River after awards press time last December combined with its September acquisition of Velocity Solutions

Golden Cufflink Award – It’s a TIE:

- Mark Starybrat from fiVISION – Mark goes above and beyond in demos to talk up client outcomes and how fiVISION will partner with the financial institution to achieve outcomes such as deposit growth. Most solutions engineers say, “Hey, this is what we have and how it’s going to work,” whereas Mark ties together the “how” with the objective. Rarely do we see outcomes spoken in demos and almost never as good as how Mark does it.

- Tamu Terlaje from Jack Henry Symitar – Tamu quickly establishes a great connection with demo participants. He knows the product he’s showing and has the absolute best demo data, weaving El Chapo and the Golden Girls into the Account Opening demo in a 30-second span. If you meet him, you know he’s not your grandfather’s Jack Henry, and bring along neon-green Post It Notes when you do.

The Jake & Elwood “We’re Getting the Band Back Together” Award – 4-way TIE: Akuvo, Savana, Enable and MX. Jay Mossman and Emily Steele built their respective Akuvo and Savana teams around their former Akcelerant (acquired by Temenos in 2015) teammates. Ashwin Goyal built his Enable team around former Terafina (acquired by NCR in 2021) colleagues. Ryan Caldwell brought back three former MX bandmates all at once a few weeks ago. Wow! Honorable mention goes to brothers Noel and Liam Gallagher for literally getting the band back together again for a 2025 Oasis world tour. Supersonic!

Swanky Swag Award – to Q2 for custom hats at The Financial Brand Forum in Vegas. We don’t know if hats build up digital banking pipelines, but it’s hard to argue with personalized, sun-safe style. Never thought we’d see Ron Shevlin in a cowboy hat either.

Guerrilla Swag Award – to Baker Hill for “Stop Using Pen & Paper (and Excel, too)” labeled paper booklet and pen set at the Bank Director AOBA conference.

FBAAS (free-beer-as-a-service) Award – goes to Sarah Martin and team at Pulsate for their beer pong booth set up at several conferences. Routinely the most prospects and cackling laughter per square foot of any vendor booth we’ve ever seen.

Best Sales Collateral – Alkami. Stephanie Massey and Kristen Bryce have developed marketing collateral that highlights the business problem the bank or credit union is trying to solve along with specific use cases and successful outcomes that another FI had while using their products. Wow, rather than a bunch of screenshots of software and buzzword BINGO words, you mean a banker can actually see how another banker solved some of the same key problems? Good job, Stephanie and Kristen – you have set the bar for how outcomes matter.

The Disaster That Keeps Getting Worse Award – goes to the whole fiasco involving Synapse and Evolve Bank, creating the biggest bruise on the face of banking-as-a-service in the history of the industry. Hats off to Fintech Business Weekly for in-depth coverage.

MISCELLANEOUS AWARDS

Smoke-from-Home Award – to the industry executive who switched their company to work-from-home, reporting an increase in employee output with a decrease in facilities expenses … adding this pièce de résistance: “We even closed that one yellowing, brown smokers-den-office.”

Crowdstrike of the Year – goes to Microsoft for shutting down half of the free world.

The Bad Influence Award – goes to the influencers telling their followers about the “infinite money glitch” for ATMs. 2024 saw Tik Tok influencers sharing how their followers could get unlimited cash from several institutions’ ATMs due to a “glitch.” The catch – the people seeking free funds used their own accounts to deposit fake checks and then withdrew cash using the FI’s funds availability policy. And here we thought that Check21 was going to kill kiting in 2002.

Best Article Headline – Goes to CU Today for “‘Bitcoin Jesus’ No Savior, Says Justice Department as it Makes Arrest”

Worth Watching? – The FDIC’s Rule Proposal would end a common banking-as-a-service practice that allows banks to count deposits originated by financial technology partners as core and require them to classify the funds as brokered.

Untargeted Marketing Award – To the well-known CRM vendor that pinged a Cornerstone consultant on LinkedIn with an unsolicited sponsored blast offer for how our “financial services firm” should attend their big conference with other financial service firms so we can get a 188% ROI with their system. Shouldn’t the CRM system know Cornerstone is a consulting firm? Or that the consultant already knows a dozen contacts at their company?

Tale of Two Cities Award – LinkedIn. It was the BEST of times: commercial networking gorilla and maybe the best acquire-and-grow asset ever (Microsoft stock is 800%+ since the 2016 acquisition). WORST of times: unsolicited connections and referral requests from strangers. Ugh!

“No Sh*t, Sherlock” Award – goes to the vendor who cited the research that “100% of all financial institutions report using automation.”

Best Candor During a Fintech Pitch – Debbie co-founder and CEO Frida Leibowitz at the Reseda Summit for saying “financial literacy is BS” on stage.

The Robin-Who? Award – goes to a rising stable of robo-advisor wealth tech firms marketed to regulated depository institutions to defend against established challengers like Robinhood and Betterment. Award winners include AlgoPear, Atomic Invest, CU WealthNext, Fintron (acquired by Apex Fintech Solutions in October), FusionIQ, InvestFI, Marstone, and TAPP Engine (and we probably missed one or two).

Most Flawed Marketing Idea – Binance for its Crypto perfume. There were a lot of screwy things happening around international women’s day. This one made our list: Binance launched a limited-release crypto perfume “to attract” women into crypto.

Best Quotes of the Year

- “Data isn’t scarce, critical thinking is.” – a sentiment offered up by Taylor Nadauld at nCino’s Executive Summit within its nSights conference (said with respect to the scarcest resource in the economy today)

- AI Trifecta Award goes to Bain Capital’s Sarah Hinkfuss for this nugget at Finovate Fall: “The best #ai use cases are ALL THREE: cheaper, faster AND higher quality.”

- “Great wines always make great friends.” – Alfred Tesseron, Pontet Canet

- “Don’t wait for the action to come to you, go to where there is the action,” to paraphrase Western Alliance’s Ken Vecchione

- Challenge from the Challengers Award goes to KBW’s Tom Michaud for this nugget from Bank Director AOBA: “Fintech investment hit a reset, but it’s here to stay… non-banks are growing faster than banks.”

- If you’re in a knife fight, you better damn well bring a knife.” – JP Morgan CEO Jamie Dimon at the American Bankers Association’s Annual Convention

- Industry Zeitgeist Award goes to Encore Bank COO Erin Simpson with “Deposits may be the biggest industry topic of the past year, but fraud will be the biggest industry topic of the next year.”

- Another great Jamie Dimon quote when he shrugged off President-elect Donald Trump’s announcement that Dimon would not serve in the incoming administration, saying he is not interested in having a boss. “First of all, I wish the president well, and thank you. That’s a very nice note,” Dimon said. “But I just want to tell the president also: I haven’t had a boss in 25 years, and I’m not about ready to start.”

In Remembrance – The Cornerstone team will forever remember Anna Dodds, our director of talent development who tragically passed away this year. Anna believed in our mission and our team like no one else and her inspiration will live in our hearts forever.

As we close 2024, we also mark the 30th anniversary since tech maverick Bill Gates pronounced, “Banks are dinosaurs, we can bypass them.” And though Microsoft enjoys a market cap of over $3 trillion, Mr. Gates did not destroy banking, and we at Cornerstone are pleased. To quote from the great holiday classic “It’s a Wonderful Life”:

“Each man’s life touches so many other lives. When he isn’t around, he leaves an awful hole, doesn’t he?”

The U.S. grassroots financial system made up of regional and community banks, credit unions and supporting fintech entrepreneurs is worth fighting for. It’s the lifeblood of local economies. It’s the niche players who create diversity and resiliency. It’s the constant check on “the man” to never become too arrogant with power and scale.

We believe this amazing and uniquely American system will not thrive unless we all have the courage to transform and be creative – to shed yesterday’s banks and build Smarter Banks. Our awards celebrate the bankers who are fighting this fight and keeping the human aspect of financial services alive and kicking. Keep it up and join the fight.

The team at Cornerstone wishes you wonderful holidays, and rest up for an “off to the races” 2025.