Becoming a Smarter Bank

Achieve your strategic outcomes. Outpace the competition.

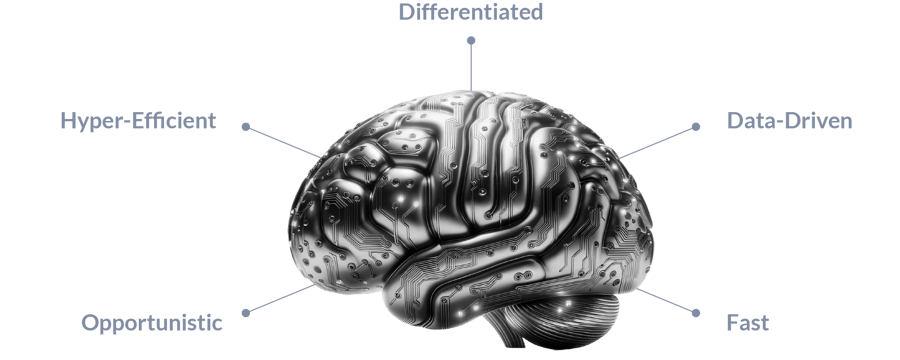

Defining the Smarter Bank

Being a 'smarter bank' is about achieving outcomes. It’s about creating a differentiated brand that stands out in a sea of mediocrity. Hyper efficient and nimble, a smarter bank uses data as a weapon, driving sharper, faster and more strategic decisions. Unafraid to take risks, a smarter bank seizes opportunities, whether that is a merger of equals or a digital or core technology transformation.

Hyper-Efficient

Groundbreaking efficiency will be the hallmark of the Smarter Bank, driven by a combination of digital self-service, process automation and artificial intelligence.

Differentiated

To compete with non-traditional banks, the Smarter Bank will need to shrug off plain vanilla “sameness” and forget distinct competitive positions and segmented brands.

Data-Driven

Smarter banks will need to take inspiration from trailblazer organizations that know how to drive value by leveraging data to make better, faster and more informed decisions.

Opportunistic

Whether it’s M&A, talent carve-outs, new market entries or new lines of business, Smarter Banks will be the ones that know when to move and look for opportunities—particularly when the industry is inward focused and risk averse.

Fast

Forget annual planning cycles. Banks and credit unions that intend to survive in a technology-first era understand they are in a constant “release” environment and must continually balance structure with “getting stuff out the door fast.”

Future-Proof by Becoming a Smarter Bank

Achieve the Outcomes You Want With Our Bold Solutions

For more than 20 years, Cornerstone Advisors has delivered gritty insights, bold solutions and data-driven performance improvements to build smarter banks and credit unions. It's time to thrive and achieve your desired outcomes with Cornerstone.

Additional Resources